Changing Financial Year in MYOB Acumatica: Year-End Procedures

Most modern ERP systems, like MYOB Acumatica (formerly MYOB Advanced), don’t require a year-end rollover process. They do however require new posting periods to be created and certain year-end reconciliations to be completed.

Below is a video that outlines the best practice processes to complete a successful year-end in MYOB Acumatica, or download the guide here.

.

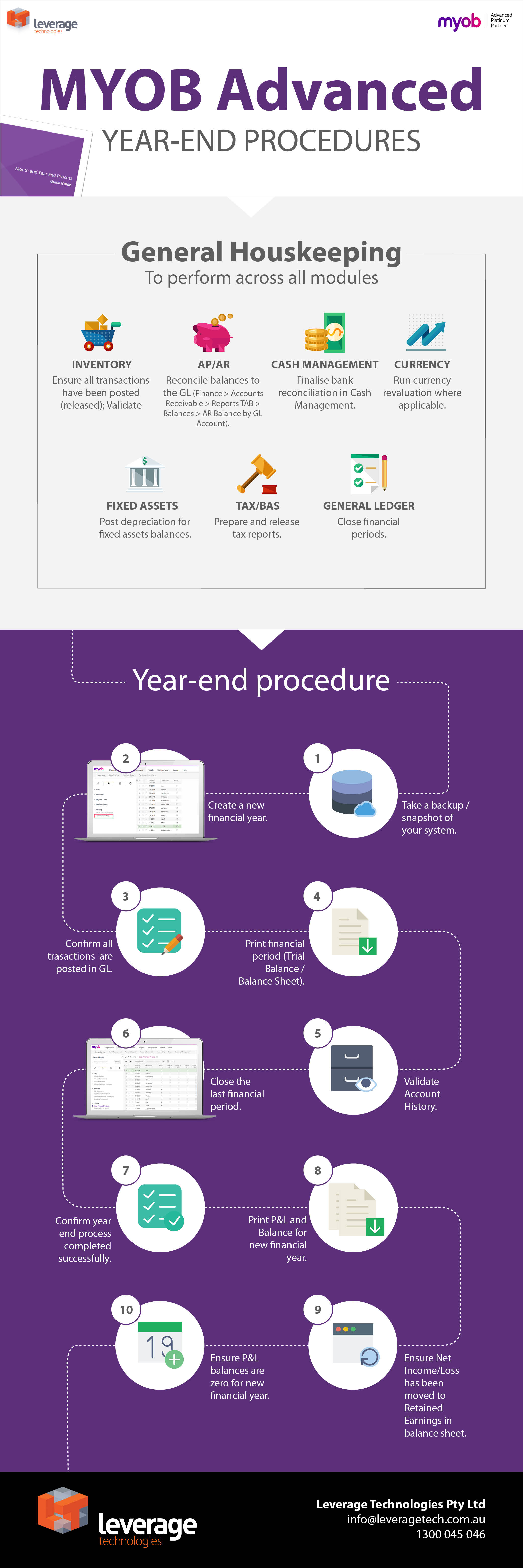

General MYOB Acumatica housekeeping across all modules

- Ensure all transactions have been posted (Released);

- Validate balances;

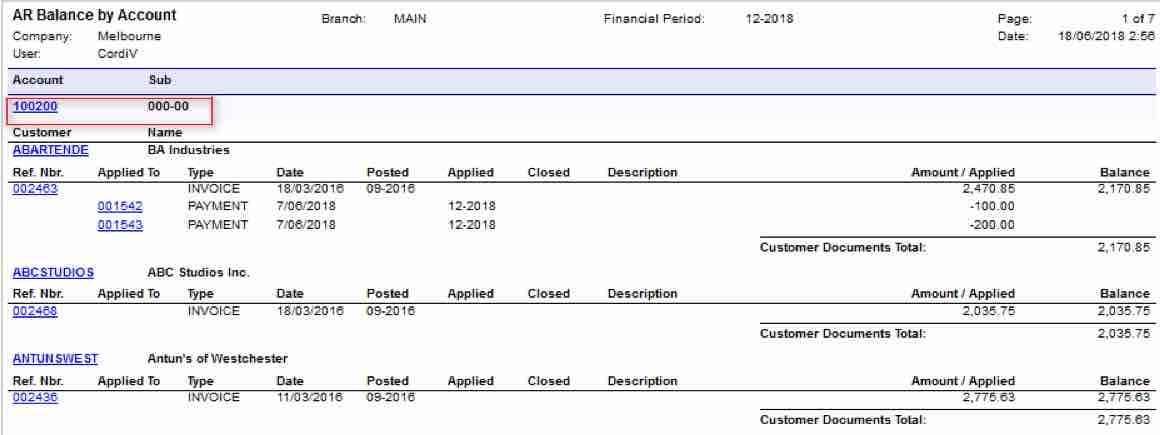

- Reconcile balances to the GL;

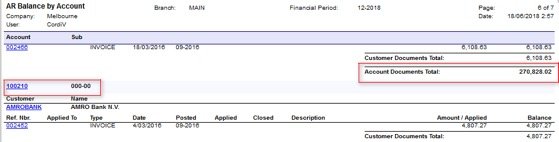

- Finance > Accounts Receivable > Reports TAB > Balances > AR Balance by GL Account;

- Finalise bank reconciliation in Cash Management;

- Run currency revaluation where applicable;

- Post depreciation for fixed assets;

- Prepare and release tax reports;

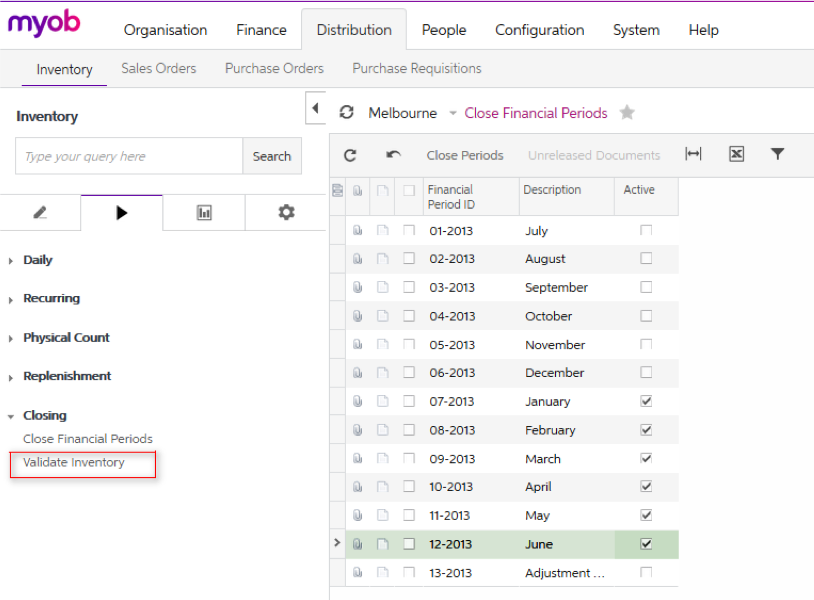

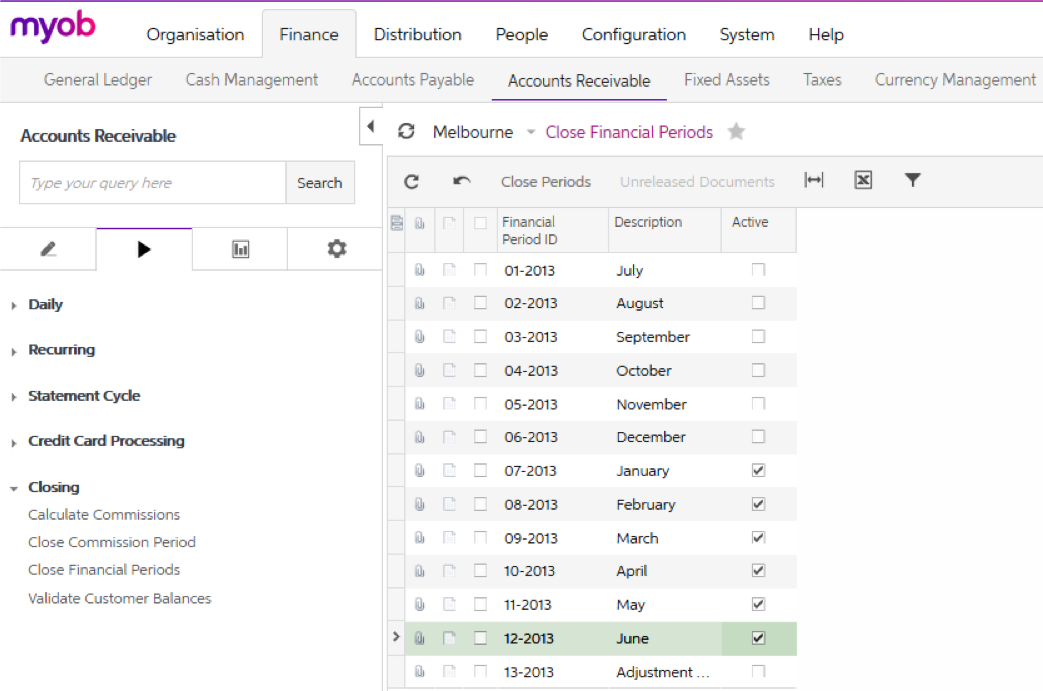

- Close financial periods;

- Take a backup/snapshot or process in a test environment.

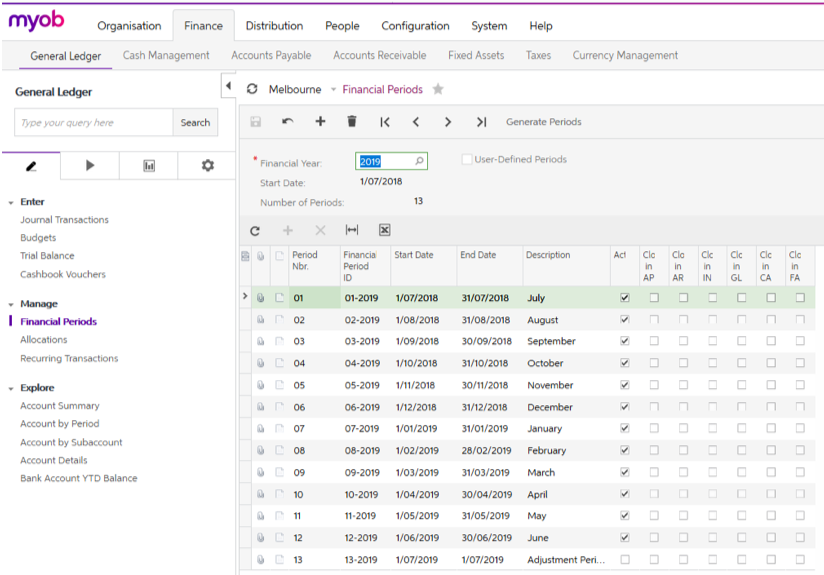

- Create the new financial year;

- Confirm all transactions are posted to GL;

- Print financial reports;

- Trial Balance;

- Balance Sheet;

- Validate Account History;

- Close the last financial period;

- Confirm year-end process was completed successfully;

- Periods for a new financial year should appear in the Close financial period section;

- Print P&L and Balance for the new financial year;

- Ensure Net Income/Loss has been moved to Retained Earnings in the balance sheet;

- Ensure P&L balances are zero for the new financial year.

Leave A Comment