Transforming the financial sector with MYOB Acumatica

There is no better way to understand a concept or solution than to see it in action.

MYOB recently published a new, brilliant MYOB Acumatica (formerly MYOB Advanced) Case Study of a company called Octet Finance. Octet engaged Leverage Technologies to implement MYOB Acumatica and migrate the data from the old system, Microsoft Dynamics NAV.

In this article, we are going to review the story and also provide additional information on the MYOB Acumatica system.

Why the need for a new ERP system?

Since 2008 Octet Finance has helped businesses connect with suppliers through supply chain financing tools.

The company has grown exponentially ever since its inception and today has a global reach, providing financing solutions to growing businesses in over 72 countries.

Until 2017, Octet had outsourced its accounting to a third-party firm but the need to adopt top more sophisticated accounting practises led it to make big changes. In particular, Octet was facing challenges related to:

- Obsolete practises – Millions of data points being produced year on year put significant pressure on the existing accounting system.

- Multi-company and multi-currency – Consolidation challenges due to the complexity of multiple companies operating in the same group, across different regions and currencies.

- Lack of live visibility – Octet was unable to get the depth of detailed reporting and analysis that it required to make informed business decisions. The existing account system produced high-level financial statement analysis, but Octet was unable to capture more detailed segmentation across salesforce, products and customers.

- Slow data processing – Daily reconciliations became a heavy process for external accountants to manage.

Before implementing MYOB Acumatica, Octet Finance was using Microsoft Dynamics NAV for certain ERP functions. The company decided not to upgrade the existing system and to adopt a Cloud-based solution instead.

Why Cloud-based ERP?

- Hosted, managed and maintained by a specialised third-party provider

- Flexible payment structure

- Scalable system to support business growth

- Access your ERP system on the go, even when working remotely

After looking at SAP Business One and Netsuite, Octet realised that both systems were too complicated and cumbersome. Further investigation led them to MYOB Acumatica and Leverage Technologies.

“We wanted something that worked straight out of the box,” explains Octet’s COO, Michael Rom. “We liked the fact that MYOB Acumatica was completely hosted and that it supported our multi-company and multi-currency models. It also had a range of other integrated features that we wanted, including payroll, project accounting and fixed assets – all at a reasonable price point.”

What is MYOB Acumatica?

MYOB Acumatica is a Cloud-based ERP software for growing SMBs. Many Australian businesses that have outgrown their current accounting software and that don’t want to upgrade to a “heavyweight” ERP such as SAP Business One or Netsuite, adopt MYOB Acumatica.

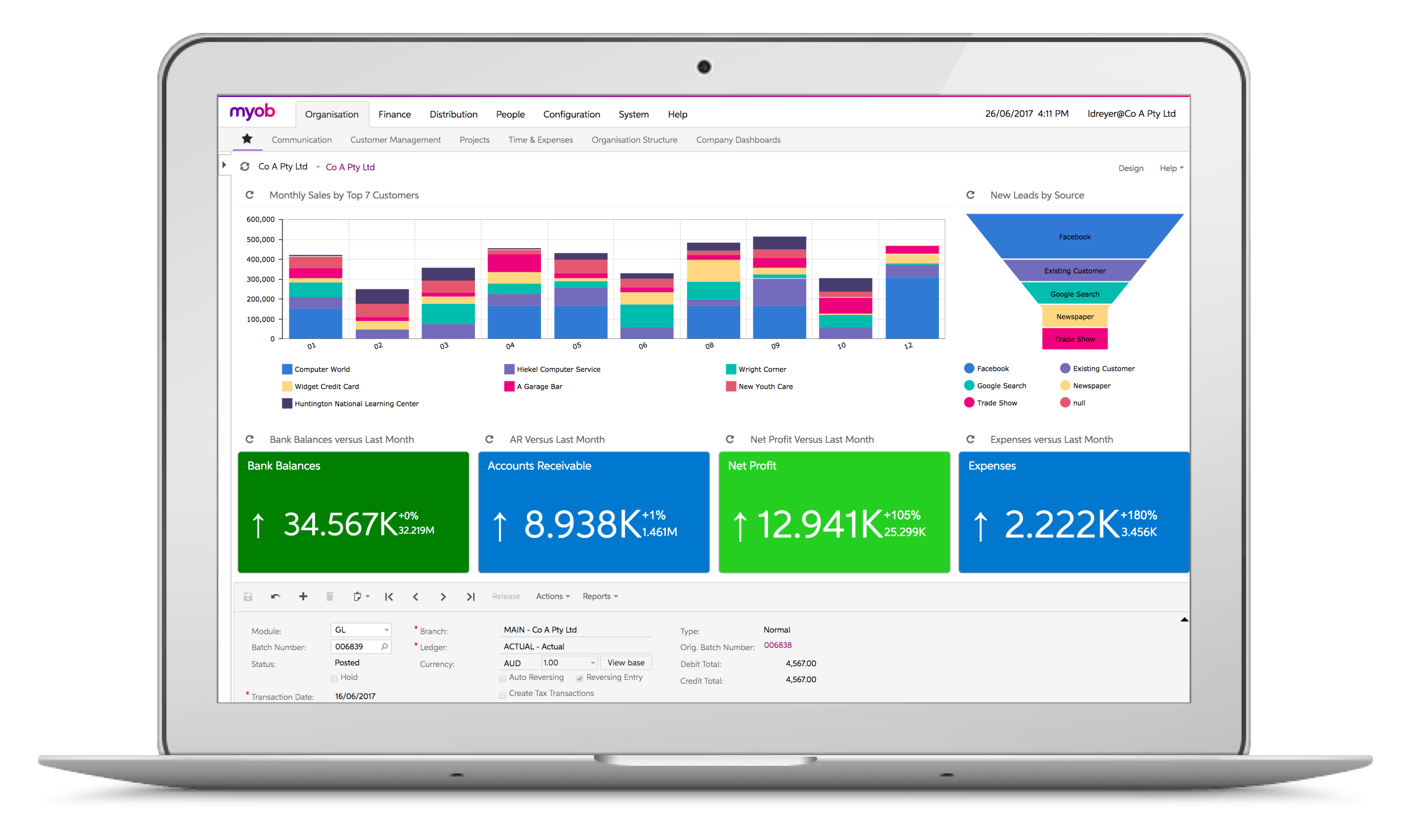

As a Cloud-based ERP system, MYOB Acumatica provides businesses with all the tools they need to run and grow a business at a reasonable price point. Key platform functionalities include

- Financial Management – Gain access to flexible reporting and analysis at your fingertips plus the tools you need to optimise your intercompany accounting, currency management and more.

- Inventory and distribution – manage your inventory more efficiently with real-time access to available inventory, inventory in transit, inventory costs and more.

- Customer Management – Get the insights you need to manage your existing customer base, run service and support and find new customers.

- Project Accounting – Leverage MYOB Acumatica to manage all your projects from a single platform.

- Payroll Management – everything you need to manage payroll, superannuation, leave entitlements and more.

Why did Octet Finance choose MYOB Acumatica?

Want to know why MYOB Acumatica is the best fit for Financial Services companies? Here is a quick overview video that shows you some of the key benefits:

Sounds interesting? Then keep reading…

How did Leverage Technologies help Octet move to MYOB Acumatica?

Leverage impressed Octet with its thorough knowledge of its business needs.

“We felt they were equipped to be responsive to us and deliver what we were after. They were very patient and ticked all the boxes as to what we were looking for in a partner. They walked us through the whole process and their technical specialist got on very well with our team. Every time we threw a question at them, they had an answer. It’s a great engagement and we’re super happy,” Michael says.

“For instance, we have to extract information from the ERP system to import into the accounting system. Previously we were uploading that manually, which was quite laborious. They helped us automate that process, enabling us to pull the data out of our system via an API and import it directly into MYOB without human intervention. That was a huge time saver and supports our strategy of being able to look at a single customer view at all times.”

Real-time data visibility means proactive business

With MYOB Acumatica, Octet now has real-time visibility across the business. Leverage Technologies set up a metric-based dashboard for statistical journals, for a view of performance that delivers useful Business Intelligence.

Managers who used to wait till month-end for a high-level generic report with no drill-down capability can now run their own reports when they wish. They can click on an individual item and view all the files and attachments.

“We can see how our products are performing in Victoria or New South Wales, for instance, or we can create dimensions for salespeople or business units, and run reports on any combination of those designations,” Michael says.

Octet’s operations are targeting paper-free processing, with data now being exported from Advanced into its own tech platform, and electronic approval delivering documents directly to the appropriate manager to sign off. The elimination of loads of manual drudge work has pleased everyone.

“We’re hoping to grow our business tenfold in the years ahead,” he concludes. “MYOB Acumatica has helped us to be much more nimble in our approach.

It’s helping to support our forecasting and to give stronger incentive programmes to our team because everyone has real-time visibility into how we’re performing.

For more information, view the official case study. Want to learn more about the Cloud-based ERP system, MYOB Acumatica? Request a FREE demo or call 1300 045 046 to talk to one of our friendly MYOB Acumatica (formerly MYOB Advanced) consultants.

Leave A Comment